Education in Nigeria is viewed as a foundation on which individual and, therefore, national development occur. Nevertheless, it is a fact that the costs of education are increasing year by year, which is a painful point for many students.

Fortunately, there are solutions today thanks to the advancement in technology. With the presence of student Loan Apps in Nigeria, pursuing your academics is possible even if you are limited in funds. Loan applications for student loans have emerged as a worthy tool which Nigerian students use to access loans for their education in this challenging economy.

Between skyrocketing tuition fees, mountains of textbooks, and living expenses, it’s no wonder many students turn to loans to bridge the gap. In recent years, student loan apps in Nigeria have emerged as a popular option, offering a seemingly quick and convenient way to access funds.

This writing will take a deep look into the top student loan apps that are making education more accessible than ever.

Table of contents

- Why are loan apps important to Nigerian Students

- Is it difficult to get loan as a student in NIgeria?

- Which is the fastest loan app in Nigeria?

- Are these loan app approved by CBN?

- How to choose a student loan apps

- What are the features to look out for when choosing a student loan app?

- Best Student Loan Apps in Nigeria

- FAQs

- Conclusion

- References

- Recommendations

Why are loan apps important to Nigerian Students

Student loan apps have become a game-changer for many Nigerian students. Unlike traditional bank loans with their lengthy paperwork and stringent requirements, these apps often boast a faster, more accessible application process.

All you might need is your smartphone, a valid ID, and maybe even your BVN (Bank Verification Number) to apply. Sounds too good to be true, right? Well, there are a few things to consider.

Read Also: 20 Apps to Make Money Online in Nigeria as a Student

Is it difficult to get loan as a student in NIgeria?

In Nigeria, obtaining a student loan from banks in the past required numerous documents, guarantors, and a healthy credit record, which students lack. These hurdles have been eliminated in student loan apps which only require a smartphone and access to the loan app.

However, this does not necessarily imply that it is easy. Certain apps may contain additional costs, relatively higher interest than that of conventional banks, and shorter durations of loan repayment. Terms and conditions should be read very carefully before signing on any dotted line.

Which is the fastest loan app in Nigeria?

Many student loan apps assure “instant approval”, which does not mean the money will be in your pocket the same day. However, the time taken may still differ and some of the apps may take longer to verify some of the details thus delaying the availability of the funds.

However, QuickCheck and Payhippo have proven to be the fastest student loan apps in Nigeria.

Read Also: 21 Best Budgeting Apps for Students 2024

Are these loan app approved by CBN?

Loan apps have become prevalent in Nigeria, which is why the CBN-Central Bank of Nigeria, has had to intervene to regulate the market. Not all applications are equal and some might be operating outside the regulation of the CBN.

This means it’s useful to only apply for student loan apps that are approved by the Central Bank of Nigeria in order to avoid scams.

How to choose a student loan apps

Do your research: Do not rush on the first application that you come across in the advertisements. One can read online reviews, check the interest rates and look for a lender who CBN has approved.

Understand the terms and conditions: This is important! Be very clear on the rights and obligations which include the mode and period of repayment, charges for delayed payments and any other charges which may be incurred.

Borrow what you can afford to repay: A student loan is not something that should be taken lightly. Do not take up more loans than you are capable of repaying once you’re done with your studies.

What are the features to look out for when choosing a student loan app?

Choosing a student loan app that has the right features can make it easy for you to navigate through. Most confusion and mistakes students make stems from selecting an app that is difficult to use and having terms that are cumbersome to read.

So, the next time you want to choose a student app loan, consider loan apps that has some or all of the following features.

User-Friendly Interface

Clear and simple structure which allows to have better control over your student loan. Search for an application that would give you good and easy-to-understand information about your loan information, your repayment status and so on.

Mobile Accessibility

Select an app that can be utilized on a phone or tablet for convenient use. This enables one to keep track of your student loan, balance, payment options and status of your loan using a mobile phone at the comfort of your convenience.

Loan Customisation Options

The flexibility of decision making about the loan terms including fixed and variable interest rates and the time period of the loan makes sure that the loan suits the needs and expectations of the borrower.

Flexible Repayment Options

Ensure that there are flexible repayment terms such as income based repayment, temporary suspension of payment (deferment and forbearance), etc. Repayment flexibility means that the borrower has the possibility to freely decide on the terms of repayment of the borrowed amount.

Payment Due Notifications

A good student loan app should be able to have timely payment reminders and notifications. This allows you not to miss your payments and thus avoid late charges.

Interest Rate Reduction Scheme

Some apps let you pay less interest by making timely payments or signing up for automatic payments. It will help you to save more money over the period of the loan.

Customer Support

The availability of timely and accurate customer support is an important factor. Select an app that has more than one complaint-handling option including phone, email, or live chat to help with any issues or problems.

Financial Education Resources

In its broadest sense, a student loan app could include elements such as useful links to financial education articles, advice on budgeting, debt and future planning. This can help to enable you to make better choices with your money.

Loan Forgiveness Information

Where relevant the app should offer details on the type, terms and possibility of loan discharge or cancellation. This is especially true for federal student loans as these may qualify for forgiveness under certain conditions.

Best Student Loan Apps in Nigeria

1. Branch

Branch is unarguably one of the most popular student loan apps in Nigeria. It allows students to secure loans for education instantly. It is not restricted to students but can be a ready-made pool of funds for student needs. It has an uncomplicated application process and also provides loans promptly which makes it suitable for emergent educational purposes.

2. RenMoney

Another recognized and prominent student loan app in Nigeria is RenMoney. It provides numerous loan types, including education loans.

The education loan aims at meeting the costs of tuition fees, books, and other needy expenses to ensure that students have access to a dependable form of financial assistance marked with reasonable interest rates besides reasonable repayment schedules.

3. Carbon (Paylater)

Carbon was originally called Paylater, is a student loan app that offers special educational loans that can meet students’ requirements. Students have an opportunity to finance tuition fees, accommodation and many other costs with the help of Carbon at rather low interest rates.

4. FairMoney

This is another upcoming student loan app in Nigeria. FairMoney provides easy access to loans for various people, including students. Equipped with a simple application and a short turnaround on approval, FairMoney is effective in helping students with the financial aid they require.

5. PalmCredit

PalmCredit is a loan app for Nigerian students, which allows users to receive loans with little or no hassle. While not strictly for educational purposes, it can be an opportunity for students who have limited finances. Through the use of technology, PalmCredit enables students to get loans to cater to their education expenses at a glance.

6. QuickCheck

The Fintech Company QuickCheck is reputed to be one of the best student loan app for students in Nigeria. QuickCheck is not exclusively designed for educational purposes; however, its efficacy as an assistance tool for students in difficulty cannot be denied.

It has a simple application process, and the company also releases loans promptly within a short period, which makes it good for educational needs.

7. Aella Credit

Aella Credit is a fintech company that operates an app, which provides loan services for Nigerian students, including loan services. Their education loan product targets the students in order to help them finance their education at higher learning institutions.

By ensuring that they offer competitive interest rates and they assure their consumers of the best then Aella Credit is a reliable option for students.

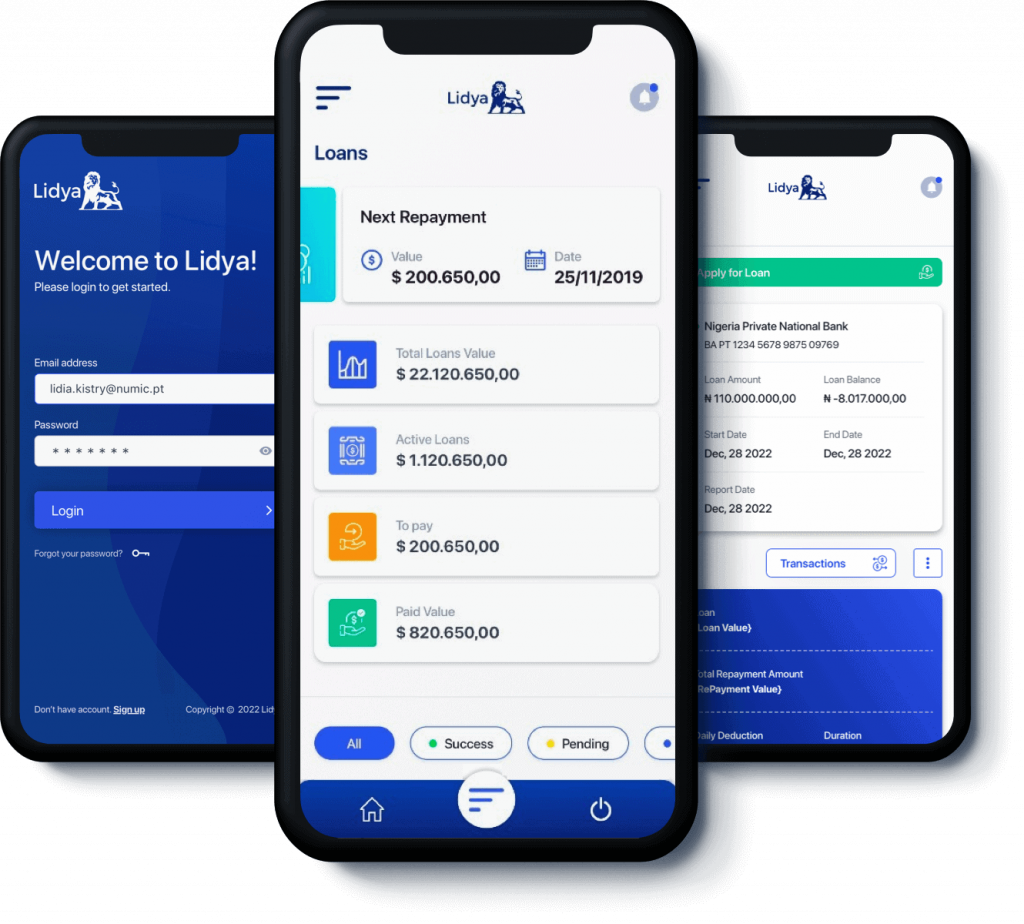

8. Lidya

Lidya is a digital lending company that offers student loans for interested Nigerian students. While Lidya is not strictly an educational platform, it can be useful for student entrepreneurs seeking to finance education.

Lidya targets students with business goals and objectives due to its short time response to application and disbursal of loans.

9. KiaKia

KiaKia is an online lending platform that offers quick and convenient loans to the students in Nigeria. It is not primarily aimed at education but may be useful for students seeking funding assistance. Due to the simple interface and fast approval of loans, It is useful for students with financial problems.

10. Page Financials

Page Financials is a loan app that deals in several forms of loans. This includes education loans for indigent students. They offer loans with reasonable interest and manageable repayment schedules.

For this reason, it makes it a suitable option for students. Also, Page Financials provides financial advisory services, which may be useful for a student who has to deal with his or her money.

FAQs

Palm Credit

Microfinance Banks, NGO/Microfinance Institutions, Financial Cooperatives, or Finance Companies.

You can borrow money from Opay by creating an Opay account and submitting a loan request on the app.

Conclusion

Student loan apps are one of the innovative financial tools for funding your education in Nigeria. However, one needs to be caution while approaching them. As long as you are aware of the possible drawbacks and do some research, you are free to use these apps to your advantage and accomplish your scholarly objectives.

It is therefore important to note that the best student loan application is that which is most suited for the specific need and financial ability of the applicant.

References

- edu.saschoolsnearme.co.za/best loan app ng/

- blog.nairacompare.ng/top 10 loan apps for students in nigeria

- thestudententrepreneur.org/loan apps for nigerian students

- nairaland.com/best loan app students